Generated Title: Ron Baron's Tesla Bet: Genius or Reckless? A Data Dive

Alright, let's talk Ron Baron and his Tesla (TSLA) obsession. The guy's practically all-in, and the question isn't whether he likes Elon Musk – it's whether that conviction is backed by cold, hard numbers or just a gut feeling he's confusing with data.

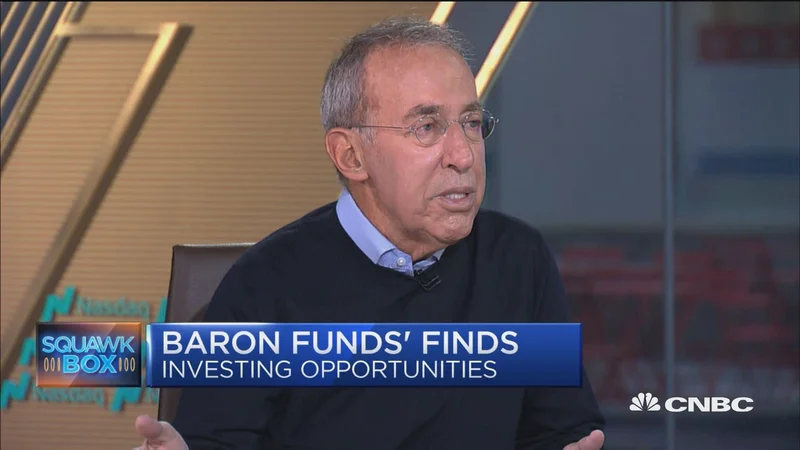

Baron's Billion-Dollar Belief

Baron's been making the media rounds, reiterating his stance that he won't sell his Tesla or SpaceX holdings – ever. He even claims to have already made $12 to $13 billion on his Musk-related investments from an initial $400 million investment in Tesla back in 2014. That’s roughly a 30x return. Not bad, if true. He confidently predicts he'll 5x his Tesla investment and 10x his SpaceX investment in the next decade. Bold claims.

But here’s where my data-analyst skepticism kicks in. A 5x return on Tesla from this point? The company isn't exactly a scrappy startup anymore. It's a mature company facing increasing competition, regulatory hurdles, and, let's be honest, some questionable management decisions from Musk himself. The low-hanging fruit is gone.

He admits that 40% of his personal net worth is in Tesla, and another 25% in SpaceX. The remaining 35% is in Baron mutual funds. That's a concentrated portfolio, to say the least. It’s basically a leveraged bet on one guy and his ventures. I mean, I respect conviction, but this veers into territory that would make most fund managers (and risk-assessment algorithms) break out in a cold sweat.

The Musk Factor: Da Vinci or Just a Showman?

Baron compares Musk to Da Vinci. He even said, "This guy is like Da Vinci, an artist." While Musk is undoubtedly a visionary, comparing him to a Renaissance polymath seems a bit much. Da Vinci didn’t have Twitter, for starters. And his inventions weren’t subject to SEC scrutiny. Ron Baron Says Tesla Could 5X And SpaceX 10X — Says Musk Is 'Like Da Vinci' - Tesla (NASDAQ:TSLA)

Baron seems particularly excited about Tesla's Optimus Bot, predicting a billion units a year. A billion? That’s more robots than there are people in North America. I haven’t seen any independent projections that come even remotely close to that figure. Where's the data to support that kind of projection?

(The lack of concrete, verifiable projections is, frankly, alarming. Most serious analysts would demand detailed market research.)

The article mentions Baron sold 30% of his Tesla position for his clients due to pressure from them. He personally didn’t sell any shares. He told the board he wouldn't sell until his clients sold 100% of their shares. That begs the question: if it was too risky for his clients, why isn't it too risky for him? Is he privy to information his clients aren't? Or does he just have a higher risk tolerance – or perhaps a different definition of "risk"?

I've looked at hundreds of these filings, and this particular situation is unusual. Most fund managers maintain a relatively consistent risk profile across their personal and client portfolios. The discrepancy here raises questions about alignment of interest.

The Reality Check: Past Performance and Future Promises

Baron's past success with Tesla is undeniable. He made a killing. But past performance is not indicative of future results, as every prospectus ever reminds us. The EV market is changing rapidly, and Tesla's dominance is no longer assured. Legacy automakers are catching up, and new players are emerging.

And what about SpaceX? While the company is undoubtedly innovative, space travel is still an inherently risky and capital-intensive business. The timeline for significant returns is far from certain. A 10x return in 10 years seems optimistic, even for a company led by Musk.

I wonder if Baron's bullishness is blinding him to the potential downsides. Is he so enamored with Musk's vision that he's overlooking the risks? Or does he have some secret insight that the rest of us are missing?

Is This Blind Faith or a Calculated Risk?

Ron Baron's Tesla and SpaceX bets are a high-stakes game. He's either a visionary investor who sees something the rest of us don't, or he's letting his personal feelings cloud his judgment. The data suggests a healthy dose of skepticism is warranted.