Is This the End of Volatility? SVXY's Wild Ride and What It Means for Your Portfolio

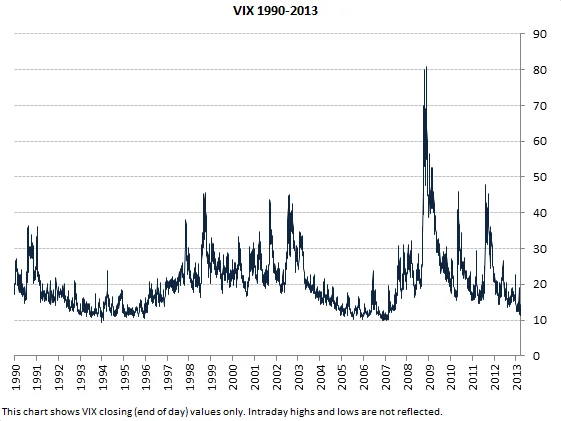

Okay, let's dive into something that’s been buzzing around the financial world: the ProShares Short VIX Short-Term Futures ETF, or SVXY for short. Now, I know, exchange-traded funds might not sound like the most thrilling topic, but trust me, this one's got some serious implications. We are talking about a fund that offers inverse exposure to the VIX, the Volatility Index.

Imagine a world where you could bet against market fear. That's essentially what SVXY aims to do, offering -0.5x the daily performance of its benchmark. It's like a financial jujitsu move, using the market's own energy against it.

The Allure (and the Danger) of Shorting Volatility

The idea behind SVXY is pretty straightforward: when markets are calm, volatility tends to decrease, and SVXY profits. Buy-side equity analyst Michael Del Monte's recent article on Seeking Alpha highlights this. It’s designed for short-term hedging and tactical trades. Think of it as a quick in-and-out strategy, capitalizing on brief moments of market tranquility.

But here's the catch, and it's a big one: volatility is, well, volatile. Unpredictable spikes can wipe out gains in a heartbeat. And because SVXY is geared, those losses can be magnified. This isn't a set-it-and-forget-it investment. It's more like riding a bucking bronco – exhilarating, but you better know how to hold on tight. The geared structure, while offering the potential for amplified gains, also means performance deviations can occur over longer holding periods. So, what does this mean? It means that this ETF is not for those who have an aversion to risk.

This is the kind of thing that reminds me why I got into this field in the first place. The blend of math, psychology, and the sheer unpredictability of human behavior—it's endlessly fascinating. What if you could predict these spikes? Or even better, what if you could create a system that thrives on them?

Think about it: what if SVXY is a glimpse into a future where we can not only manage risk but profit from it? It's a bold idea, I know. It also brings a moment of ethical consideration. Are we creating tools that benefit everyone, or just those who understand the game?

Now, I know, some of you might be thinking, "This sounds like a recipe for disaster!" I get it. The market can be a scary place. But consider this: every major technological advancement has come with its own set of risks. The printing press led to misinformation, the internet opened doors to cybercrime, and AI… well, we're still figuring that one out! But we don't abandon progress because of potential pitfalls. We adapt, we learn, and we innovate.

A New Era of Risk Management?

Maybe SVXY is a stepping stone towards a new era of risk management. Imagine a future where sophisticated algorithms can predict and mitigate volatility spikes in real-time, protecting investors from devastating losses. What if we could use these tools to create a more stable and equitable financial system? SVXY: Inverse VIX Exposure To Enhance Market Strategy (BATS:SVXY) - Seeking Alpha could provide additional information on this topic.

The speed of this is just staggering—it means the gap between today and tomorrow is closing faster than we can even comprehend. This uses inverse exposure—in simpler terms, it means betting against the VIX. When I first saw the concept, I honestly just sat back in my chair, speechless.

SVXY: A Sign of What's to Come?

So, what's the real story? The ProShares Short VIX Short-Term Futures ETF isn't just another financial product; it's a sign of things to come. It's a glimpse into a future where risk is not something to be feared, but something to be understood, managed, and even harnessed. It's a wild ride, no doubt. But it's also a reminder that the greatest rewards often come from embracing the unknown.